Understanding B2B Sales

In product management, we talk a lot about empathy, but it often falls short with our internal stakeholders. Why is this the case, especially with our colleagues in sales?

Not too long ago, I made a brief pivot into sales ops. I learned a lot about the complexities of B2E sales. Nothing makes the divide as transparent as when you move to “the other side”.

In this article, we dive into the nuance and complications of direct sales to large companies. We will talk about the role of the sales person in a later article.

Contents:

This article is available in audio, narrated by me, recorded in 3 parts.

Chapter 1: The Background

Chapter 2: The Enterprise Tier

Chapter 3: The Buyer

Chapter 4: Decision to Replace

Chapter 1: The Background

Product vs Sales

I spend a lot of time with B2B product managers and leaders. With the exception of the seasoned product veterans, when you mention the word “sales", scowls or fear comes crashing into the conversation. It’s quite the trauma response.

“Why can’t sales people just do their job? I’m always on sales calls!”

“Sales always want me to build these things that make no sense.”

“I had to throw out my roadmap several times to ‘save the deal’. Why do I do any strategy work? Nobody even used the feature after!”

“We talk to the users directly. Who needs the sales filter?”

It is really important for us to unpack this deeply systemic, multi-faceted issue. The current product attitude towards sales becomes unhealthy very quickly. Conversely, in order to advocate for better product management practices in our organizations, we need to understand the complexity of B2B sales.

PLG = A Panacea?

Aside from AI/ML, Product-Led Growth (PLG) is the hottest thing in product management in 2024. One common belief is that PLG means you build your product to sell itself. For many B2B PMs, the unspoken excitement revolves around the self-serve B2C-ification of B2B products, which means no more salespeople! Beyond the Panacea!

Panacea (noun) - A remedy for all diseases, evils, or difficulties; a cure-all.

- The Free Dictionary

Given Sales is still a thing, evidently that is not how it works.

B2C and PLG Product Managers may not have people explicitly labelled “sales” in their organization. By selling through major partner channels that require negotiated agreements and ongoing relationship management, things start looking quite sales-y with similar demands.

Take a look at almost any B2B pricing page, there is always a tier called “Enterprise” with a “Contact” option. If it’s not there yet, well... it's only a matter of time.

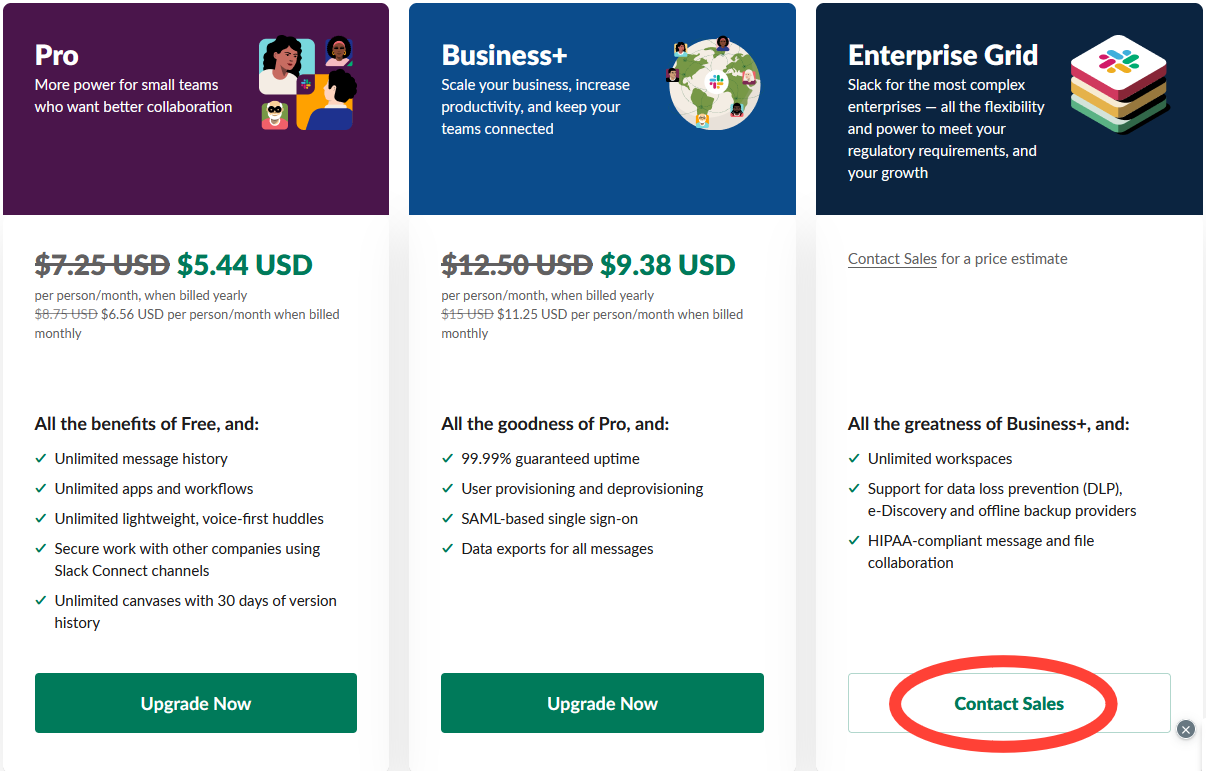

Here’s Slack:

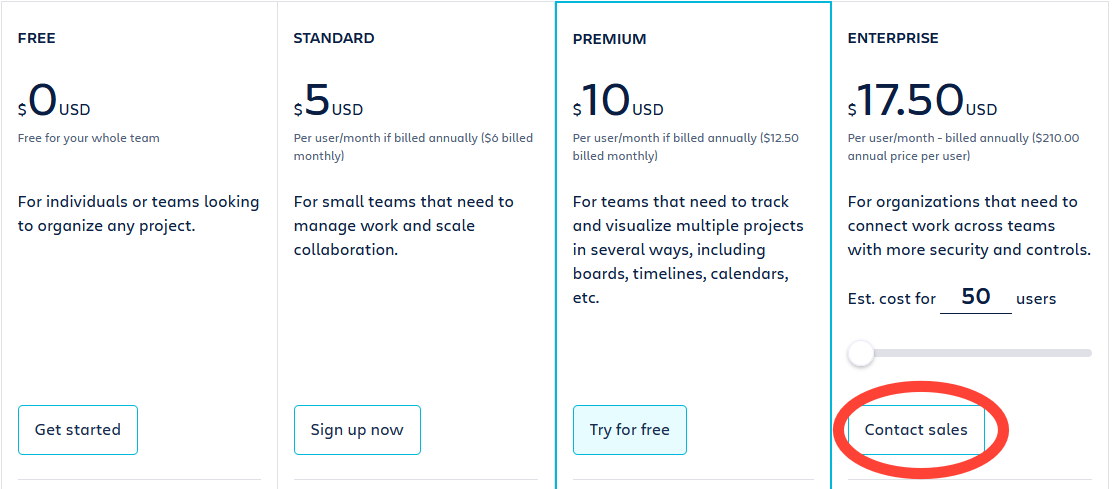

Here’s Trello:

Not convinced? Google Workspace. Miro. Productboard. Pendo. Sales Cloud.

This strategy is not just for unicorns. Here are some much smaller brands for comparison: Surfe. DataDog. Roadmunk. DoubleLoop. (DataDog allows you to buy their plan, but offers bulk discounts if you talk to them. You’re going to talk to them.)

Smarter people than me have written about why this is the case:

- Elena Verna's fabulous article on how to transition from PLG to sales.

- Evan Armstrong's analysis of how Qualtrics ate SurveyMonkey's lunch by going enterprise first instead of PLG.

Welcome to the world of Enterprise Sales. Time to embrace these realities. There is no escape.

Services vs Product Organization

We tend to see many more sales-led companies in the B2B space. Huge companies are typically willing to pay a lot of money for the right solution. They tend to have needs and demands that an out-of-the-box solution would not be able to meet.

Enter the Services organization. It’s a win-win. The customer gets what they want. Why not tack on services to make more money?!

Services vs product deserves its own article series, but this article doesn’t make sense without addressing this as a root cause of the damaged relationship between sales and product. Rich Mironov has written some incredible articles on this topic: Product Models & Value; Services to Product.

In mixed product/service companies, services include custom configuration; technical onboarding work by customer success groups; building unique data connectors; creating bespoke mobile apps; analyzing clients’ data for individual insights; building custom websites; designing marketing campaigns for clients; turning a customer’s internal toolkits or architectures into finished applications. And any software we build and sell once to the client who paid for it.

- Rich Mironov, “Moving from Services to Products”

Services has become emblematic of the struggle between bespoke customer requests and good product management. Sometimes these requests are aligned with our product strategy. Many other times, these scenarios clashes with the vision and the approach. Even when all services are profitable for your company, should internal tools to facilitate services ever be a priority? As a product leader, where do you draw the line between longer term strategic value and near-term revenue?

If you’ve worked in enterprise software, you know that the bigger the deal, the more pressure to insert “deal-winning” features into the roadmap. If you win enough of these deals and requests, you will stop making progress towards strategic initiatives. This is a product manager's worst nightmare.

Smaller companies will deliberately target smaller teams and SMBs to avoid being held hostage by large deals.

Recommendation: Your organization’s strategic focus must be a collective deliberate decision by the leadership. Your target market and operating model impacts what and how you build, and therefore IS the culture of your company. It’s not enough to say that you are a product company. Consider how you might implement this in practice.

Chapter 2: The Enterprise Tier

(If you’re not familiar with the MegaCorp, read part 1 here.)

For clarification, when I say “Enterprise sales” in this article, I am referring to a sale to a huge organization. Here, you are subjected to the full weight of the standard procurement process of the customer, as opposed to something as simple as a manager sign-off.

When you sell to a huge company, you have all of the complexity in the sales cycles. It doesn't matter if the product will be used by 1 team or the entire org. Enterprise Sales are tough no matter how big the deal itself actually is.

Here are the main factors that make Enterprise deals different.

Stickiness

Deal volume aside, enterprise deals are extremely attractive to product companies because they’re so very sticky. Customers buy a product to facilitate an internal process or need. It is a lot easier to replace something 10 people use, versus something that’s deeply integrated into 100’s or 1000’s of people’s work and tooling.

Think about something that everyone uses at work. How hard is it to replace it? Slack, email, your CRM, the underlying data architecture. The compliance tool that sits in-between 3 different systems and processes all of your data every day. Now think about these mechanics when your company is 10x or 100x larger. Larger companies tend to have more bespoke tools and solutions.

There is very little political will to ever replace a system once it’s in place. It takes a deep, concerted hatred and an eager person in leadership to replace a system in a huge enterprise.

Time to Displace

The easy step: When does your customer have funding available to make the purchase?

The complicated step: Your customer likely has something currently in place to solve this problem. How do you displace the existing solution?

Many enterprise agreements have a fixed term contract. I’ve seen 1, 3, 5, 7, 10 years, depending on company policies, customer geography, and the type of product. The larger the deal, the longer the fixed term tends to be. As a customer, when you've spent several years implementing an enterprise-wide solution, you want to minimize the operational risk associated with that vendor, including price fluctuations, or support terms.

Depending on the length of your sales cycle, many sales engagements tend to start long before the contract renewal time to allow the customer adequate time to displace and replace the incumbent solution. Do you need to ALSO go through the RFP (Request for Proposal) process? This might take a while. After all this effort, you might not even win the RFP.

Timing the sales cycle to when it would save the client the most money may also be strategic, though it does come with risks. Given the implementation complexity, the customer usually needs to have both solutions running in parallel during implementation and validation. They cannot shut off the old solution until yours is in production. The worst case outcome is that your product’s implementation is delayed, and the incumbent solution refuses to renew the client’s contract for a short term.

Operational Risk

Larger companies come with compliance regulations, processes, and legal teams. They will not sign your contracts as-is. I've seen some companies require every single purchase involving a license to go through legal/procurement, including lower risk purchases like a Calendly license. While this is slowly changing, it is still the norm. Legal often has issues with the boilerplate services agreement. As a vendor, it is not cost effective to negotiate contracts for deals under a certain revenue threshold. This is why PLG licenses tend to be super generic.

The process of getting through your client’s compliance requirements is called “Vendor Onboarding”. The bigger and more regulated your client OR the smaller the vendor, the more difficult it is to get through this process.

Here are some common compliance requirements that I’ve seen. Every single one of these requires you to provide documentation of an audit, certification, or a statement.

- Anti-child labour and anti-slavery

- Environmental sustainability standards

- Economic sanctions compliance

- SOC1 & SOC2

- Accessibility Conformance Report

- Regional labour law compliance

- Restrictions to regional data access

- GDPR and other data privacy legislation, plus general user data privacy

- Business insurance

- Business continuity planning

Aside: Musings on Compliance (Click to expand)

I once spent 3 months working with the account manager trying to figure out how to answer questions to do vendor-re-onboarding after our company was acquired. It took me down the rabbit hole of legal entities across jurisdictions, European compliance laws, and the corporate structure of the new parent company.

At one such huge company, there was one “insurance guy”. If you were working on a contract that had a insurance requirement, he would figure out which insurance certificate to send depending on the client and deal size. The contract also usually has a requirement for you to resend the insurance certificate every year, so he had to track that compliance piece as well. If you didn’t work in sales or legal, you may never interact with this person.

In a huge corporation, there are so many of these niche roles that makes things work. If your company has a great procurement team, value them. They make everything so much easier.

This is a marketing document from Thomson Reuters selling a platform to assist with vendor onboarding. It’s a pretty decent overview of what you could come across.

There is a lot here, and if your company doesn’t have a streamlined revenue ops system, this takes up a lot of your sales people’s time. Multiply that effort across multiple deals, and you can see why these challenges exist.

The Money

By the way, integrating this new tool in all of our other systems, bespoke or purchased? This might have been a 3 year, $20M services project for a $5M licensing deal. That’s a lot of money, and a lot of opportunity. There is a lot of upfront and recurring revenue at stake here. If you were a company looking to raise more money from VCs or PEs, would you say no to raising your valuation through inflated revenue?

Chapter 3: “The Buyer”

In product parlance, we generally see “the buyer” as one person, but in reality, there are many people involved in an Enterprise-wide buying decision, especially one that impacts multiple teams. It’s often a purchasing committee. Here are some personas that represent possible decision makers. These could be the same person.

- The Signing Authority - the CXO or VP or director who makes the final purchasing decision.

- The True Champion - Usually the mid-senior manager who was the one who found the tool in the first place and really wants it to fix the issues in the team.

- Users - The team using the tool. Ideally benefits from your product

- The Manager of the people using the tool - Does this fit into our workflow? Note: This may not be the same person as the true champion.

- The people who have to Implement the solution - IT, the team doing the purchasing, project management, upstream and downstream teams and their tools.

- Downstream Teams - The people impacted by the solution post-implementation who are not the primary users of your product.

- The Purchasing Committee - everything from vendor onboarding, compliance, insurance, legal, AND the team doing the purchasing.

Signing Authority

When you get to the executive level, there is something called “Signing Authority”, which is the amount of money on a contract that a person can sign off on at their level without needing to escalate. This is a publicly available version of one such policy. (It is quite interesting as these are almost always confidential!)

Depending on the complexity and the reach of your product, many vendor companies consider signing authority when pricing. Is this product only going to touch a single department, and that director has a signing authority of $250K in this industry? You don’t price above $249K. The higher you price, the more people you bring in, and the more complex the deal. This is why PLG works. Most of these products are introduced at a very inexpensive level, then expand beyond standard thresholds through the added functionality and direct sales.

Notice that this signing authority also applies to when you sell something. We’ll come back to this in a follow-up article when we talk about our sales people.

How This Plays Out

At a globally-recognized company in a very niche space, less than 20% of the leads started with a CXO. Most of the successful sales started with a True Champion because it solves the problem that their team has been facing. The Champion understands the solution's VALUE.

The users come into the process during tool selection. Sure, your solution might replace their 40 daily spreadsheets, but if a competitor is easier to use, then you now have a much harder time selling, even if you offer the more comprehensive solution. When you factor in the implementation costs and sales timeframes, suddenly this deal is even less appealing to the buyers.

The enterprise sales cycle is LONG and STICKY. Once you're in, the users are stuck with you until the next time they get budget and support to implement a new tool. It's often easier to just live with the terrible tools. This is a humongous set of processes.

In the world of enterprise products, we talk about decades of longevity. No wonder so much of the focus is on buyers... however...

The Users Become the Buyers

We need to keep in mind where the new sales are coming from. The True Champions are people who are often new managers or senior managers. They come from roles in other companies where they've used products like yours. If they loved the user experience, they're much more likely to promote YOUR solution and push it over everything else. It doesn't take much for someone to say "I hate <this brand>". Even if the vendor fixed those problems, the sentiment of bad customer experience sticks throughout their career.

A great user experience that provides value increases longevity and your odds of winning the deals today while cultivating future new true champions in the market. Word of mouth does wonders at industry events. It is the best marketing you have.

Chapter 4: Decision to Replace

Congratulations! Your prospective client (“Prospect”) hates their existing solution. They’ve made a decision to try something new. Let’s understand the process of replacing an existing system.

The decision to replace is one thing, but what do you replace it with? Generally speaking, the person leading the change has used a competitor or has been influenced by the competitor’s sales/marketing and thinks it would work much better here. Often, people get hired into these positions specifically to lead the replacement of legacy systems. In many large companies, successfully implementing new systems is how you move up in the ladder.

Here’s the usual process, assuming everything goes according to plan:

- Understand the general sentiment in the organization for or against replacing the existing system.

- Find out how much the replacement might cost, including implementation and downtime.

- Determine if your department has budget. If not, could you get the budget given the proposed improvements in efficiency (or whatever metric you’re solving for)?

- Make the case for it.

- Does your company require an RFP? Do that.

- Go through the LENGTHY sales process. Here be compliance.

- Sign agreements.

- Implement.

Get your promotion and move on before the implementation is even done.Next leadership hire scraps the project and starts their own.Rinse & repeat.- UAT

- In Production! Transition from the implementation team to customer success & support.

It’s never easy. By the way, if the salesperson or anyone else says the wrong thing at any point in this process before signing, the deal is dead.

Closing

My intention is for product managers to think about how we could better set up our salespeople for success. "Our market" includes the complexities of how we sell, especially if we want the benefits that come with the Enterprise Tier.

Given what you've read, it's now time to think about these things:

- How is your product sold?

- Is your Product buyable?

- Why is this sales person so insistent on this one feature?

- (and is it valid?)

Understanding the sales landscape opens up better conversations about your strategic market focus. Perhaps there's something you can add that makes sales a lot easier. Perhaps your messaging needs work.

Sales is very much an essential partner to the success of the product. Talk to them.

Acknowledgements

Thank you to these people for helping dig deeper into the sales and marketing perspectives along the way: Sophia Goh-Manuel, Amy Conrad, Anton Mamine, and the countless others who answered my questions.

Editorial and editing support from: Elliot Golden. This article is so much better thanks to their input.

Other News

- Welcome to Context Soup's new home! We're off Substack for the reasons listed here and here. Hope you enjoy your stay. I am really enjoying Ghost's writing experience.

- I've added a Helpful Links page for my favourite reference articles and links to great community groups.

As always, thank you for reading!

Context Soup © 2024 by May Wong is licensed under CC BY-SA 4.0.